Division of

Military Retirement Pay - Area Method

© 2018

Brian Mork, Ph.D. [Rev 2.1]

Home •

Site Index • Wiki • Blog

Update: The 2017 National

Defense Authorization Act changed the definition of "Disposable

Retirement Pay". This mimics the calculations discussed here -

one coverture fraction for time or points, and a second coverture

fraction for rank/longevity or salary. However, as of January 2018,

phone calls with DFAS

paralegals confirm the only type of divison they accept for

post-NDAA2017 cases is the Hypothetical Method. DFAS is implementing law intent by ignoring the law's letter:

The Hypothetical Method percentage they calculate must be applied to the

old definition of DRP. Otherwise, the discount is double-applied:

once by the ratio of hypothetical salaries and once inside the

definition of DRP. When the marriage

starts after the military career,

or with multiple spouses, the Area Method is still the only way to

equitably calculate the marital asset. Additionally, the dual

covertures in the Area Method can accomodate both the intent and letter

of the new law. For more

information, see the web page tutorial on the

USFSPA amendment in the 2017 NDAA law. .

Abstract

This document presents the Area Method (AM) or Dual Coverture Value

(DCV) method of

dividing a military retirement upon divorce. Because the name DCV

confused people, the name was changed to a more descriptive "Area

Method". Original research reveals the Area Method accomplishes

the

same

division as older methods, yet is simpler. AM

also applies to a much wider scope of life situations which were

previously impossible. AM works for Active Duty or Reserve, and any

combination of marriage before or after military duty - even multiple

marriages. For a Reservist, it also properly handles Reserve early

retirement (retirement payments before age 60, earned and accrued only

after January

28, 2008). No other method

can do all of this with equity. AM can save

significant litigation costs because the simplicity and clarity invite

equitable mediation.

This page includes a lot of mathematics. Another web page gives practical information

about using AM in the legal system. Single

Coverture and Dual Coverture are discussed on other web

pages. A letter

to DFAS proposes the Area Method to replace the Hypothetical Method

because it is easier and more capable and backward compatible.

Introduction

USFSPA

laws allows military retirement benefits to be divided as a present day

asset rather

than future income. Doing so often manifests in a divorce order

that

says the spouse is awarded nominally 50% of the "military retirement

earned during the marriage." You cannot believe how unecessarily

complicated it has gotten to actually describe what portion

was earned during the marriage!

The stakes are large.

Military retirements are a significant benefit,

earned by both women

and men. As of March 2011, there were more

than twice as many military women divorcing (local

copy) than men. Among

enlisted, the military women divorce rate is

about 3x that of men. The overall military divorce rate in 2011

is

64%

higher

(local copy) than it was in 2001.

Military

divorce is a significant social issue

affecting both sexes. Dollar value of a military retirement in 2012

dollars range from $945,000 for an E-7 to

$2,800,000 for an O-8 (20 yr E-7, or 30 yr O-8, living until age

75).

AM discussed

in this document addresses how to describe what part of a military

retirement is divisible as a marital asset and calculate the coverture

fraction needed by the military Defense Finance and Accounting Service

(DFAS). Athough AM is applicable to Active

Duty and Reserve

military retirements, if you are intested in Reserve military

specific issues,

please also see another web page about dividing

military reserve retirement pay. Additional web pages deal

with law and statutes,

promotion enhancements,

dual

coverture, practicum

and examples, and a proposal

to DFAS.

Discovery

My graduate degree taught me to handle data and numbers with fidelity,

and to provide defensible answers that represent truth. My

aerospace

flight test engineering work involves using data and metrics to create

and test

models of the real world on which people's lives depend.

Mathematical tools are used to monitor, verify, and predict the real

world. I turned these skills toward division of military retirements.

I developed the Area Method (AM) model of military retirements that

allows easy math to divide

this marital asset in the case of divorce. Division methods have

accumulated since the 1982 USFSPA laws and a 1998 Department of Defense

Report to Congress regarding the functionality of USFSPA laws.

Spouses, attorneys, and judges have struggled to understand the

military retirement system and have grappled with equitable division

through

lengthy, repeated, and narrowly scoped litigation.

The new AM

model offers a better way! AM is a family of division

formulas that are plug-n-play replacements for the complicated

DFAS methods that exist for both Reserve and Active Duty

retirements. At the same time, AM can divide military retirement

assets in marriage situations

that DFAS methods simply cannot do. AM even can do multiple ex-spouses

rather than the inequitable "first come first serve" method DFAS is

currently limited to (see "Maximum Percentage" paragraph in a summer

2000 article published in General

Practice, Solo & Small Firm Division magazine.)

Over the last few years, I have had the

opportunity to consult for attorneys and clients going through divorce,

and AM has proved to be particularly useful in arbitration and

mediation because it is so lucid that it removes the desire to

litigate. I am looking for

professional review from the legal

community, and partners to publish AM in family law journals and other

newsletters reaching out to educate family law attorneys.

Comparison of Methods

When dealing with future disbursed civilian retirements, a coverture

fraction

typically calculates what portion of a retirement was earned

during the marriage and is a marital asset. The marital asset

portion is then divided like other assets. This is a core concept: although a

military retirement can be treated as a marital asset, most times only some

of the military retirement is a marital asset.

Quantitatively

describing the marital portion is the key to all division

methods. The marital portion is usually expressed as a fraction

or percentage (not

a dollar value) because the size of the retirement paycheck changes

each year based on changing military salaries:

Ex-spouse monthly payment =

Share Fraction * Marital Fraction * Changing Military Retirement

Pay

The goal is to determine the Marital or Coverture Fraction, multiply by

the Share Fraction (often 50%), then document the percentage number in

a court

order. Each month, DFAS will multiply that percentage by the

retirement pay and determine the ex-spousal payment. A hierarchical

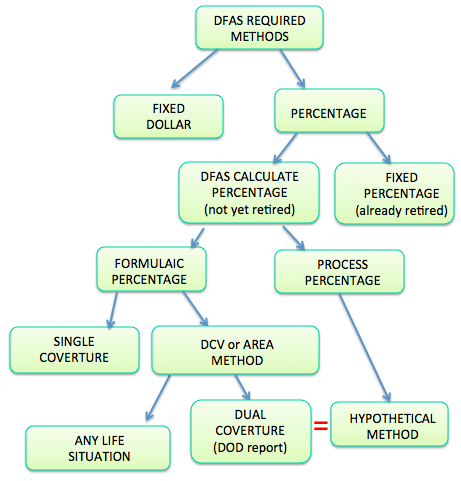

diagram of all methods is given below. It helps to

understand that the purpose of any method is to simply generate a

marital fraction. After

all the effort is said and done, creating the percentage number is the

entire point of all the methods except the fixed dollar method.

The red equal sign in the green flowchart above is meant to indicate

that the Dual Coverture and

Hypothetical

methods yield the same percentage if one stipulates that COLA is the

same as military pay raises each year. Much more documentation is

available from the references

below.

Some authors, such as attorney Mark Sullivan in his "Silent Partner"

series, misrepresent this issue. For example, on Page 7 of

his "Military Pension Division: The Servicemember's Strategy" edition,

he states, "There are four separate ways to make the division that DFAS

will accept." This is not true.

Sullivan fixates on Fixed Dollar, Percentage Clause, Formula, and

Hypothetical because the DFAS document "Guidance on Dividing

Military Retired

Pay" (see references at the bottom of this webpage) offers these four

examples. However, examples do not delineate acceptable

division methods. In fact, there are only two acceptable division

methods for DFAS: Fixed Dollar or Calculable Percentage. Either

you give them a dollar amount, a percentage amount, or you tell them

how to calculate a percentage amount when the military member retires.

Sullivan's writing and legal document templates are

often used in court nation wide, so it's important to drive this issue

to

completion and replace Sullivan's confusion. There are TWO

acceptable ways to express a division to DFAS, and any calculation or

process or method providing one of those to ways is acceptable. If

there is any doubt, you

may reference USFSPA 10 USC 1408(a)(2)(c) directly:

"[A court order,] in the case of a

division of property, specifically provides for the payment of an

amount, expressed in dollars

or as a percentage

of disposable retired pay, from the disposable retired pay of a member

to the spouse or former spouse of that member." (underline added)

The DFAS examples of Percentage Clause, Formula, and Hypothetical

Method are simply different examples of how to calculate a

percentage. Anything that

gives DFAS a way to calculate a percentage is acceptable.

A tabular comparison of method features is

given below.

Method

of Division --->

|

Area Method

(AM)

|

Dual

Coverture (DC)

|

DFAS

Hypothetical Method (HM)

|

Civilian

Single Coverture Fraction (SC) *

|

Active Duty and Reserve?

|

Yes

|

Yes

|

Yes,

but 6 versions confuse courts

|

Yes

|

Time-value of money given after

payments start?

|

Both

receive military pay raises.

|

Both

receive military pay raises. |

Both

receive military pay raises.

|

Both

receive military pay raises. |

Time-value of money after

divorce, but before before payments start?

|

Both

receive military pay raises.

|

Both

receive military pay raises.

|

Spouses

treated differently -

military receives military pay raises; ex-spouse receives COLA

|

Both

receive military pay raises.

|

| Avoids hand-calculation of COLA

and hypothetical "High-3" basepay? |

Yes |

Yes |

No |

Yes |

| Post-marriage merit promotion

enhancements belong only to military member, per DoD report to Congress

and Appellate Courts? |

Yes

|

Yes

|

Yes

|

No

|

Able to set

aside duty value

pre-existing the marriage? (required in many states)

|

Yes

|

Yes

|

No

|

Yes

|

Able to set aside promotion

value pre-existing the marraige?

|

Yes

|

No

|

No

|

No

|

Protects ex-spouse from

pre-marital set aside at higher rank?

|

Yes

|

No

|

No

|

No

|

Handles promotions and service

credit for multiple spouses?

|

Yes

|

No

|

No

|

No

|

* Although civilian methods are inappropriate

for dividing a

military retirement, this column is included in the table because some

attorneys/courts continue to use only this method because this is what

they're familiar with.

This behavior damages military members with lack of equity, and is

inequitable in many cases as annoted above. If a myopic view continues,

courts will continue to be reversed and attorneys risk malpractice

settlements. Web page titled "Division

of Military Retirement Pay - Promotion Enhancement" gives a point

by point rebuttal to the civilian

method; continuing to use it when it's documented to be

inferior and inequitable is inexplicable.

Only the Area Method allows proper

handling of military duty and promotions that existed as a pre-marriage

asset. Like a car or dining room table

pre-existing the marriage, pre-existing assets are not divisible.

Pre-existing retirement asset value

can be quantitatively separated and does not comingle with the rest of

the retirement. Only AM can do this.

Additionally, when more than one spouse is involved, only the AM can

properly divide a military asset among multiple spouses and the

military member.

Area Method

The value of both Reserve and Active Duty retirements can be

visualized as an area. The idea of an area (multipling two

numbers toegher) works because a product of two variables is how a

military monthly retirement check is calculated, plus an extra 2.5%

factor and any conversion factor between points, months, years and

days.

Monthly retirement = (2.5% base pay) *

(service credit in years)

For example, an Active Duty person retiring after 20 years would get

50% of their monthly base pay. For a Reservist, service credit

has been expressed in points to

divide retirements. The Area Method could do fractions that

way, but instead points are

converted to months to maintain similarity with Active Duty

retirements,

and to match the Federally

mandated retirement formula,

which converts all points to years. For a Reservist, the Federal

goverment defines years = points/360, so months = points/30.

In the

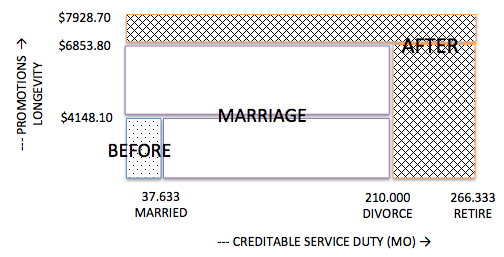

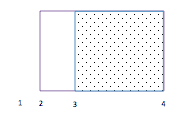

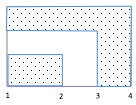

diagram below the

horizontal axes shows the number of months of military duty for

retirement.

This example happens to be from a Reservist, so the numbers were

obtained from points. The military member had 1129 duty points when

they married (1129/30=37.633 mo), 6300 points (210 mo) points when

divorced, and 7990 points (266.333 mo) as of retirement.

The vertical axis is monthly base pay looked up on a pay chart for a

single year (2009 in this example). You can use whatever year you

want, but all three values

on the vertical axes are looked up on the SAME paychart.

Do not look up the earlier

values using earlier pay charts. Use the same year paychart to find

basepay

of the different ranks and different times.

Because the

numerically precise and quantifiable nature

of a military retirement allows such calculations, there is no

comingling.

The area

of any part of the diagram

represents asset value. The white part of the diagram shows the

portion of the total retirement that is a marriage asset. The

white part is to be divided. The shaded parts are not to be

divided.

Consider the three separate, non-comingled portions that constitute the

entire retirement value. Remember, asset value is represented by

area of the

diagram:

- Before Marriage.

Dotted area. The dotted portion earned before the marriage is not a

marriage

asset. It pre-existed the marriage and because of this, it is not

a marital asset according to state law in almost every state of the

union. The area value is quantifiably separate, and is not

co-mingled like a bank account brought into marriage. When

listing assets during divorce discovery, each party

lists bank accounts and assets. During this time, it is

appropriate to note "militarly retirement asset presently worth 2.5% *

$4148.10 * (1129/360) yr = $325.22/mo"

was earned before the marriage, and is quantifiably separable, and is

not co-mingled with anything during later years, and is not a marital

asset. This is identical to listing a car or motorycle or dining

room table you owned before the marriage, and having those items exempt

from division.

- During Marriage. White

area. This area is typically the asset portion divided.

- After Marriage.

Cross-hatched area. Case law sometimes allow

civilian passively-earned enhancements after a marriage to be divided

when the receiving party has to wait to get the money. Duty

points and promotions earned after marriage

are not

passively earned like interest on a bank account or time-value of money

or dividends of a 401(k) type retirement. Dividing passively earned

enhancements may be appropriate to return time value of money --

appropriate for an investment or bank account that can not yet be

transfered. However, military duty and

promotions are actively earned

enhancements based on effort, schooling, study, and testing. They are

not passively earned like bank interest; they are earned by additional

work and

effort. Done

after marriage, this effort is not shared by an ex-spouse. This area of

enhanced retirement value earned after the marriage is not a

marital asset and should not be divided.

If you want to try numbers specific to your situation,

download the Area Method calculator

spreadsheet (pre-NDAA 2017 or post-NDAA 2017) from the references section below.

A practicum with

step-by-step examples is also available. A letter

to DFAS includes a spreadsheet

showing the Area Method or Dual Coverture Value calculations.

To divide assets, there is a certain sequence a court

must do. If any one of these steps are skipped, court orders are

susceptable to successful appeal, assuming proper documentation was

submitted during the original court action. Here

are the steps:

- Determine if something is a marital asset. USFSPA allows, but

does

not direct, a court to consider military retirement as a marital asset.

However, all portions of a military retirement

are not marital assets unless all

of the military career was during the marriage.

- Determine asset values as of some date. This is typically

the date of separation, the date of filing divorce, or the date of

final divorce order. Specificity and precision of military

retirement formulas makes this easy.

- Decide how to divide the asset. Many courts go with 50:50.

Sometimes there are legitimate reasons to deviate from this, but it's

usually an uphill battle to argue against 50:50.

Formula and Legal Language

The Area Method coverture fraction is calculated by

diving the

value of

the white portion area of the above diagram by the total area

value. It's that simple! No other pre-existing method is

anywhere close to this level of simplicity. William

Troyan, of Troyan, Inc writes that the New Jersey appellate court

decision to use Dual Coverture makes the preparation of division orders

substantially more complex. I disagree: AM methods are simple! It's just

that nobody prior has envisioned

and communicated the simple "before-during-after" area diagram

displayed above.

The area of the white

area does not change later in life based on the military members

actions. No matter

how much additional duty is done, it

never dilutes in value. If promotions occur, other parts of the

diagram become larger, but the marital asset portion does not become

larger or smaller. However, all portions of the chart do become

larger

if there are military pay chart increases. Also, if a military

person does not ever

retire, then nobody gets any retirement, and in the words of a Michigan

Appellate court,

"awarding 50% of nothing is not in error."

Another option

would be to enslave the military person by forcing them to continue

enlistement until retirement, or try to obligate non-military

retirement, which would be out of scope of UFSPA and earned outside the

window of marriage. Conflicting with this, some attorneys like

Willick have suggested forcing military memers to retire ASAP to get

the payments started.

The AM coverture fraction describes what portion of the total monthly

retirement

pay is a marital asset by dividing the white

portion area of the diagram by the total area:

C = ( DDVD-DMVM

) / DRVR

C = (210 * $6853.80 - 37.633 * $4148.10) / (266.333 * $7928.70)

C = 1283191 / 2111677

C = 0.6077

C is the coverture fraction

D is the duty months at marriage, divorce, or retirement

(according to the subscript)

V is the value base pay at marriage, divorce, or retirement

(according to the subscript), all from the same year pay chart.

Multiply the coverture fraction by the disposable retirement monthly

payment, and you will

have the marital asset. The non-military spouse is typically

awarded 50% of the marital asset.

If there was no duty before marriage, on the diagram above

there would be no "Before" area and the marriage values DM

and VM

are zero, and the AM formula simplifies to the Dual Coverture method

showing a ratio of

duty days and a ratio of pay at rank.

Dual Coverture and AM give the same mathematical result as the DFAS

Hypothetical Method if one stipulates COLA raises are

the same as military pay raises. You can see they are the same my

simply moving the paratheses in the formula, while keeping the formula

the same.

C = ( DDVD ) / (DRVR

) Area Method

C = ( DD/DR ) * ( VD/VR

) Dual Coverture Method

In a similar manner, if there are no promotions involved (VD

= VR), the formula simplies to the Single Coverture fraction

that the legal system has used for years:

C = ( DD/DR )

Notice that the AM method may always be used because

the math

formula automatically simplifies to do the more simple cases.

For

this reason, AM should

always be used in court orders because nobody can predict if promotions

or additional

marriages will happen in the future, necessitating a revisit to the

court if the other limited methods were used.

The legal language to implement the AM method

for military duty both before and after a single marriage is given here

(replace all the bolded values with YOUR values). This is

the textual equivalent of dividing the white area by the total area,

creating the coverture fraction. The idea is to simply

describe the area that is a marital asset,

and divide it by the total area.

“The former spouse is awarded a

percentage of the member’s disposable military retired pay each month,

to be

computed by multiplying 50%

times a Coverture Fraction, the numerator of which is is 1283191.

The Coverture

Fraction denominator is member’s total number of duty months for

retirement times basepay upon retirement. All basepay values

will be looked up on the 2009

year pay chart. If a Reserve retirement is obtained, months =

points / 30."

Using the numbers from the continuing example above, the

marital asset would be 60.77% of the retirement net disposable

amount. Spousal portion

would be 50% of that or, 30.38%. If you wish, see another example

on the AM Practicum

web page.

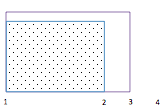

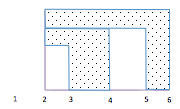

Iconic Simplicity

The AM method of diagraming phases of life

and the divisibility of

retirement earned during those phases of life is so lucid and simple

that the

area diagrams can be reduced to icons. The horizontal axes

represents time moving from left to right across the bottom of the

icons. The vertical axes represents the value of promotions and

longevity. Remember, the specific dollar amount corresponding

to any area goes

up each year as the military base pay goes up.

In each diagram below, the

white portion would be the divisible marital asset, while the dotted

portion would not be divisible. The coverture fraction is

calculated by dividing the white area by the total area.

The legal division order language would simply describe how to

calculate the white area divided by the total area. The numerator

would always be a number, and the denominator would always be the same

- waiting for DFAS to plug in numbers if the military member is not yet

retired.

Icon Picture

|

Description

of Life

|

Simplified formula calculating

white

marital portion Coverture Fraction (C). *

|

|

This

diagram represents becoming 1) married, 2) military, 3) retired, 4)

divorced. In other words, the entire military career was shared with

the same spouse. No coverture

fraction is required. Non-military spouse receives

nominally half of the disposable monthly retirement payment.

|

C = 1.0

|

|

This

diagram represents becoming 1) married, 2) military, duty with or

without promotions, 3) divorced, duty without promotions, 4) retired.

Because there are no promotions after the marriage, this can be handled

like civilian retirements with a single coverture fraction.

|

C = DD/DR

|

|

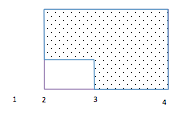

This diagram represents becoming

1) military, 2) married, duty and promotions, 3) retired, 4) divorced.

|

C = (DRVR-DMVM)/(DRVR)

|

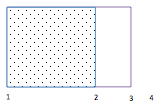

|

This diagram represents becoming

1) married, 2) military, duty with or without promotions, 3) divorced,

duty with promotions, 4) retired. In this situation, the Dual

Coverture Value method simplies to the Dual Coverture method.

This will give the same result as the DFAS Hypothetical method if you

stipulate that military pay raises are the same as COLA.

|

C = (DDVD)/(DRVR)

|

|

This

diagram represents becoming 1) military, duty with or without

promotions, 2) married, duty without promotions, 3) divorced, no more

duty or promotions, 4)

retired.

|

C = (DD-DM)/DR |

|

This diagram represents becoming

1) military, duty with or without promotions, 2) married, duty and

promotions, 3)

divorced, duty and promotions, 4) retired.

|

C = (DDVD-DMVM)/(DRVR) |

|

This diagram represents becoming

1) married #1, 2) military, duty with or without promotions, 3)

divorced, duty and

promotions, married #2, 4) married, duty without promotions,

5)divorced, 6) retired.

|

C1 = (DD1VD1)/(DRVR)

C2 = (DD2VD2-DM2VM2)/(DRVR) |

* The symbols and subscripts in the third column are defined earlier on

this web page. For this chart, the formula is simplified by cancelling

common factors in the numerator and denominator.

Comparison to DFAS Examples

In the Fall 2012 newsletter of the ABA

Family Law Military Committee,

Amy Privette, a previous paralegal for Mark Sullivan, wrote an article

titled "Quick Tips for Handling Military Retirement Benefits". She

echoed her mentor's errors by

identifying four DFAS methods of dividing military pay: fixed dollar,

percentage, formula, and hypothetical award. These correspond to

Sections IV(A), IV(C), and IV(D) of the DFAS 2012 document titled

"Guidance on

Dividing Military Retired Pay."

Privette stated that award formulas had to be stated one of these

four ways to be acceptable to DFAS. This is incorrect. In fact,

there are only two (2)

acceptable types for DFAS, while DFAS gave four (4)

examples. Confusion like this pervades the area of

military retirements asset division. Quoting paragraph

IV(A) from the

DFAS document, "The USFSPA states

that for a retired pay as property

award to be enforceable, it must be expressed either as a fixed dollar

amount or as a percentage of disposable retired pay."

Notice this quote identifies 2 options (fixed or percentage), not

4.

It is critical to realize that the DFAS "formula" or "hypothetical

methods"

calculate a percentage and therefore fit into the second type.

See the green hierarchy diagram above. More

revealing is the fact that ANY method that creates a fraction

percentage is acceptable to DFAS, so long as the fraction is directly

stated, or is possible for DFAS

to calculate. In DFAS'

words, "If a court order provides a

formula award and also provides all

the variables necessary to compute the formula, we will complete the

calculation as is [sic] using those variables provided in the

order."

If the fraction or percentage from two different methods

is the same, then any two methods are the same. This appears in

the hierarchy diagram above with the red equal sign. How you got to

the fraction just doesn't matter to DFAS.

All Dual Coverture methods create fractions and can be calculated by

DFAS. It is instructional to take each of the DFAS examples of

creating fractions and correlate them to the Area Method of creating

the same fraction.

Method

in DFAS published guidance

|

Simpler

DCV Formula giving the same fraction.

|

Fixed Dollar

|

percentage calculation not

required

|

Named Percentage

|

percentage calculation not

required (just state it).

|

Formula Example 2

|

C = DD/DR |

Formula Example 3

|

C = DD/DR |

Hypothetical Example 4 & 7

|

C = (DDVD)/(DRVR) |

Hypothetical Example 5 & 8

|

C = (DDVD)/(DRVR) |

Hypothetical Example 6 & 9

|

C = (DDVD)/(DRVR) |

Consider More than Monthly Amount

Selecting the proper method from the table above will correctly divide

the monthly retirement paycheck for Active Duty military and Reserve

military. For

Reserve

military, there is also a question of which paychecks are to be

divided. The value of the retirement asset includes attention to

dividing which checks in

addition to

dividing each check.

Traditionally, Reserve military retirement checks start when the

military member turns

60 years

of age because that's when a Reserve retirement begins to pay

out. However, 10 USC 12731(f)(2)(A) created a new and

quantifiably separate retirement for Reservists that does not comingle

in any way with the traditional retirement, and is created and is

accrued only based on military duty after January 28, 2008. If

the ex-spouse did

not participate in earning the new benefit after that date, then

retirement payments before age 60 are by definition not marriage assets

and therefore not divided. For more detailed

reading, see the Reservist

retirement division web page

or the bottom of the Area

Method web page.

Besides dividing each monthly payment, some or all of the

monthly retirement payments before military member age 60 may not be marital assets. See details

in the document "Attorney Instructions - Division

of Reserve and Active Duty Military

Retirements" from the references below, and

the web page

"Attorney Guide Dividing Military Reserve Pay".

Three conditions could exist.

- If a marriage

exists only after January 28th, 2008, then the retirement asset

is to be

divided the same way as described above.

- If a marriage ends

before

January 28th, the ex-spouse in no way contributes to the

retirement points accumulated after January 28th, which month-for-month

dictate how many months prior to age 60 retirement pay is started.

Getting these extra months of pay

is based only on duty after January 28th. Under this second condition,

the payments before age 60 would have a coverture fraction of zero --

in

otherwords, the non-military spouse would receive no portion of the

payments before age 60 because the spouse in no way contributed to the

duty points causing the payments. In this situation, the asset division

order must explicitly tell DFAS to not divide payments before age 60,

and divide payments like normal after age 60.

- If the marriage spans January

28th, then the payments age 60 and

following should be divided with a coverture fraction as described in

all the paragraphs above. For payments before age 60, a new area

value diagram must be created using only points after January

28th. The horizontal axes of the second

diagram would include points ONLY earned after January 28th. The

vertical axes would start with point value as of January 28th and show

only promotions after that date. This second area value diagram

would yield a second coverture fraction to apply for all payments

before age 60. DFAS must be provided with both coverture

fractions and directed to use one before age 60 and the other for age

60 and following.

Damages

The resultant damages of doing military division with a

single

(civilian) coverture when it should be a Dual Coverture or Area Method

are significant. If someone divorced as a Major and retired as a

Colonel, the 2013 pay chart shows a 34.4% increase in retirement

(proportional to base pay) due only to the rank change attained after

marriage. Other situations would be higher or lower. Because the

34% mistake would comes from

the military member to

the

non-military member, that creates a double,

or 68% average, error in equity. This is much larger than other

differences judged to be significant by courts, including the 15%

rule

of thumb on income changes to change support payments, or the 5%

threshold where medical insurance would be ordered for a supported

child. Over a 20 year retirement, this would accumulate a

$878,481

mistake in marital asset value. Multiply this error by the number

of military in the

nation and the

number

of divorces, and you'll

see that this is a $Billion dollar issue that needs the lucid,

equitable clarity of the Dual Coverture Value method.

Conclusion

Original research

has revealed the Area Method accomplishes the

same

division as previous standard methods, yet is much simpler. AM

also applies to a much wider scope of life situations which were

previously impossible. If you want to try numbers specific to

your situation,

download the Area method calculator

spreadsheet from the references

section below.

A practicum and

example are also available.

- Mork white paper: Attorney

Instructions - Division of Reserve

and Active Duty Military Retirements (increa

copy).

- DFAS "Guidance on Dividing Military Retired

Pay", March 2014, 25 pdf pages

with bad formatting, 121 KB pdf. (DFAS.mil,

increa

copy).

- Older copy April 2012, 20 pgs, 119

KB pdf. (DFAS.mil,

increa

copy).

- Older copy "Attorney

Instructions - Dividing

Military Retired Pay", April 2001,

19 pgs, 74kb pdf. (DFAS.mil,

increa

copy).

- DoD Report to Committee on Armed Services of the US Senate and

House of Representatives, 1998, 84 pgs, 279 KB pdf. (Defense.gov,

increa

copy)

- Blog post Dual

Coverture is better than DFAS Hypothetical Method,

February 2011.

- DCV Does Simple Division Orders--reply

to William Troyan.

- (out of date - see below for update)

PRE-NDAA2017 Excel spreadsheet for doing Dual

Coverture Value (Area Method) Calculations, September

2012. Includes court order legal language.

- (out of date - see below for update)

NPOST-NDAA2017 Excel spreadsheet for doing Dual

Coverture Value (Area Method) Calculator, March 2017. Includes

court order legal language.

- UPDATE: Excel spreadsheet for

doing both PRE- and POST-NDAA2017

calculations.

- "Female GIs struggle with higher rate of divorce", March 2011. (militarytimes.com,

increa copy)

- "Air Force divorce rate highest in military", December 2011. (militarytimes.com,

increa copy).

- "Be Specific in Divorce Agreements to Avoid Future Legal

Trouble", March 2011, (airforcetimes.com,

increa copy).

This document was

edited using Kompozer. © 2017

Brian Mork, Ph.D.